selected item

2024 performance highlights

Financial performance

~$4.8B |

~$6B |

~$3.9B |

30 years |

|||

| Earnings | cash flow from operations | returned to shareholders | of consecutive dividend growth (paid basis) |

Upstream operations performance

- Achieved upstream production of 433,000 gross oil-equivalent barrels per day, representing the highest full year production in over 30 years.

- Delivered significantly lower operating costs1 across major Upstream assets.

- Achieved full-year production record at Kearl, with 281,000 gross oil-equivalent barrels per day (200,000 barrels Imperial’s share).

- Increased Cold Lake full-year production by nearly 10 percent from 2023 to 148,000 gross oil-equivalent barrels per day. This was supported by strong performance at Grand Rapids – the industry’s first application of solvent-assisted SAGD technology.

- Commenced construction of the Enhanced Bitumen Recovery Technology (EBRT) pilot on Imperial's Aspen lease with pilot start-up anticipated by 2027.

Downstream and Chemical operations performance

- Achieved average throughput of 399,000 barrels per day and refinery capacity utilization of 92 percent.

- Executed turnaround activities at all three refineries ahead of plan and below budget, including Nanticoke's most successful large turnaround event in decades.

- Construction continued on Canada’s largest renewable diesel facility at the Strathcona refinery.

- Grew branded retail network to 2,600 sites and sustained number 1 retail market share in Canada2.

- Reliable operational performance supported Chemicals net income of $171 million.

Commitment to sustainability

- Delivered strong safety performance and effective enterprise risk management across the organization.

- Pathways Alliance continued to progress early technical work and issued the request for proposals to pipeline manufacturers for the proposed transportation pipeline.

- Surpassed $6 billion in spending with Indigenous businesses since 2008, and achieved the highest annual business spend in 2024.

- The Low Carbon Solutions organization continued to evaluate and progress emission-reduction opportunities in carbon capture and storage, hydrogen, and lower-emission fuels, as well as lithium to supply the global battery and electric vehicle markets.

2024 financial & operating information

1Non-GAAP financial measure – see definition and reconciliation below

2Based on Kalibrate survey data for Q4 2024

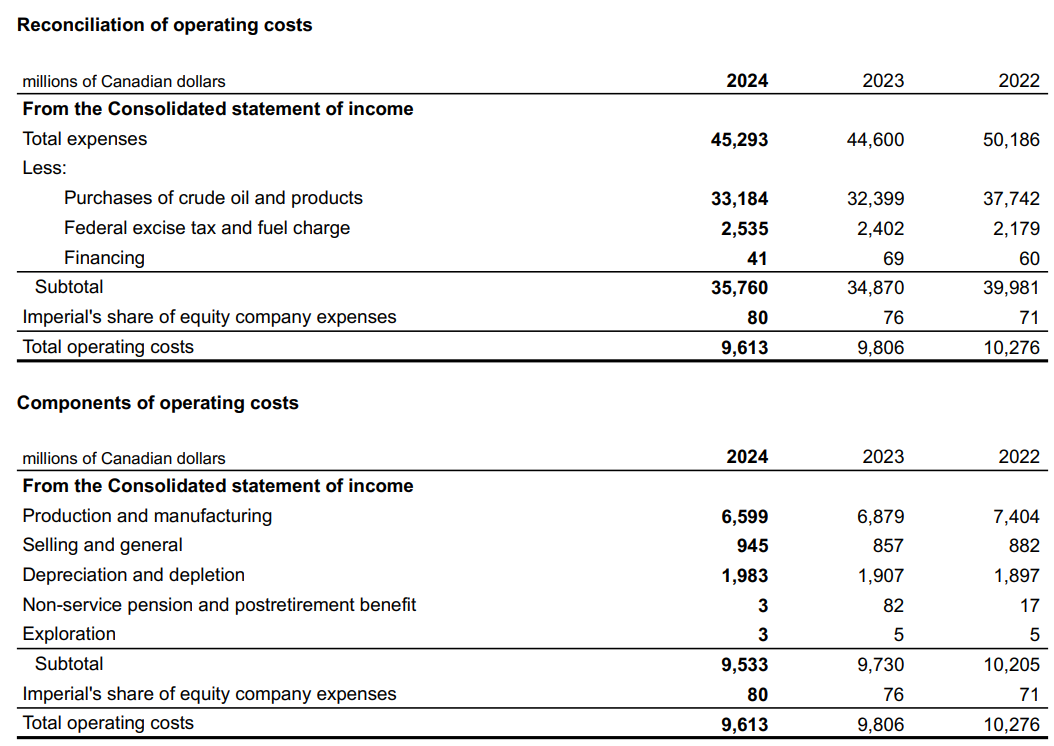

Operating costs (non-GAAP financial measure)

Operating costs is one of the company’s key business and financial performance measures. The definition is provided to facilitate understanding of the terms and how it is calculated. It is not prescribed by U.S. Generally Accepted Accounting Principles (GAAP), and it constitutes a "non-GAAP financial measure" under Securities and Exchange Commission Regulation G and Item 10(e) of Regulation S-K, and a "specified financial measure" under National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators.

Reconciliation of non-GAAP financial measures to the most comparable GAAP measure, and other information required by these regulations, is available in the "Frequently used terms" section of the company’s most recent Annual Report on Form 10-K. Non-GAAP financial measures and specified financial measures are not standardized financial measures under GAAP and do not have a standardized definition. As such, these measures may not be directly comparable to measures presented by other companies, and should not be considered a substitute for GAAP financial measures.

Operating costs is a non-GAAP financial measure that is the costs during the period to produce, manufacture, and otherwise prepare the company’s products for sale – including energy costs, staffing and maintenance costs. It excludes the cost of raw materials, taxes and interest expense and is presented on a before-tax basis. The most directly comparable financial measure that is disclosed in the financial statements is total expenses within the company’s Consolidated statement of income. While the company is responsible for all revenue and expense elements of net income, operating costs represent the expenses most directly under the company’s control and therefore, are useful in evaluating the company’s performance.

Forward looking statements

Statements of future events or conditions in this webpage, including projections, targets, expectations, estimates, and business plans are forward-looking statements. Similarly, discussion of roadmaps or future plans related to carbon capture, transportation and storage, biofuel, hydrogen, and other future plans to reduce emissions and emission intensity of the company, its affiliates and third parties are dependent on future market factors, such as continued technological progress, policy support and timely rule-making and permitting, and represent forward-looking statements. Forward-looking statements can be identified by words such as believe, anticipate, intend, propose, plan, goal, seek, project, predict, target, estimate, expect, strategy, outlook, schedule, future, continue, likely, may, should, will and similar references to future periods. Forward-looking statements in this report include, but are not limited to, references to the timing of the Enhanced Bitumen Recovery Technology (EBRT) pilot at Aspen; the capacity of the company’s Strathcona renewable diesel facility; the status of and continued participation in the Pathways Alliance; and the company’s evaluation and progress related to carbon capture and storage, hydrogen, lower-emission fuels, and lithium.

Forward-looking statements are based on the company’s current expectations, estimates, projections and assumptions at the time the statements are made. Actual future financial and operating results, including expectations and assumptions concerning future energy demand, supply and mix; production rates, growth and mix across various assets; production life, resource recoveries and reservoir performance; project plans, timing, costs, technical evaluations and capacities, and the company’s ability to effectively execute on these plans and operate its assets, including the Strathcona renewable diesel project; the adoption and impact of new facilities or technologies on reductions to greenhouse gas emissions intensity, including but not limited to technologies using solvents to replace energy intensive steam at Cold Lake, the Enhanced Bitumen Recovery Technology field pilot on the Aspen lease, Strathcona renewable diesel, carbon capture and storage including in connection with hydrogen for the renewable diesel project, recovery technologies and efficiency projects and any changes in the scope, terms, or costs of such projects; the degree and timeliness of support that will be provided by policymakers and other stakeholders for various new technologies such as carbon capture and storage; for renewable diesel, the availability and cost of locallysourced and grown feedstock and the supply of renewable diesel to British Columbia in connection with its low-carbon fuel legislation; the amount and timing of emissions reductions, including the impact of lower carbon fuels; performance of third-party service providers including service providers located outside of Canada; receipt of regulatory and third-party approvals in a timely manner, especially with respect to large scale emissions reduction projects; applicable laws and government policies, including with respect to climate change, greenhouse gas emissions reductions and low carbon fuels; refinery utilization and product sales; the ability to offset any ongoing or renewed inflationary pressures; cash generation, financing sources and capital structure, such as dividends and shareholder returns, including the timing and amounts of share repurchases; capital and environmental expenditures; the capture of efficiencies within and between business lines and the ability to maintain near-term cost reductions as ongoing efficiencies; and commodity prices, foreign exchange rates and general market conditions, could differ materially depending on a number of factors.

These factors include global, regional or local changes in supply and demand for oil, natural gas, petroleum and petrochemical products, feedstocks and other market factors, economic conditions or seasonal fluctuations and resulting demand, price, differential and margin impacts, including Canadian and foreign government action with respect to supply levels, prices, trade tariffs, trade sanctions or trade controls, the occurrence of disruptions in trade or military alliances, or a broader breakdown in global trade; political or regulatory events, including changes in law or government policy, applicable royalty rates, tax laws including taxes on share repurchases; environmental risks inherent in oil and gas activities; environmental regulation, including climate change and greenhouse gas regulation and changes to such regulation; government policies supporting lower carbon investment opportunities; failure, delay, reduction, revocation or uncertainty regarding supportive policy and market development for the adoption of emerging loweremission energy technologies and other technologies that support emissions reductions; the receipt, in a timely manner, of regulatory and third-party approvals, including for new technologies relating to the company’s lower emissions business activities; third-party opposition to company and service provider operations, projects and infrastructure; competition from alternative energy sources and established competitors in such markets; availability and allocation of capital; availability and performance of third-party service providers including those located outside of Canada; unanticipated technical or operational difficulties; management effectiveness and disaster response preparedness; project management and schedules and timely completion of projects; transportation for accessing markets; commercial negotiations; unexpected technological developments; the results of research programs and new technologies, including with respect to autonomous operations and greenhouse gas emissions, and the ability to bring new technologies to commercial scale on a commercially competitive basis, and the competitiveness of alternative energy and other emission reduction technologies; reservoir analysis and performance; the ability to develop or acquire additional reserves; operational hazards and risks; cybersecurity incidents including incidents caused by actors employing emerging technologies such as artificial intelligence; currency exchange rates; the occurrence, pace, rate of recovery and effects of public health crises, including the responses from governments; general economic conditions, including inflation and the occurrence and duration of economic recessions or downturns; and other factors discussed in “Item 1A Risk factors” and “Item 7 Management’s discussion and analysis of financial condition and results of operations” in the company’s most recent annual report on Form 10-K.

Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial Oil Limited. Imperial’s actual results may differ materially from those expressed or implied by its forwardlooking statements and readers are cautioned not to place undue reliance on them. Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law.

Forward-looking and other statements regarding Imperial's environmental, social and other sustainability efforts and aspirations are not an indication that these statements are material to investors or require disclosure in the company's filings with securities regulators. In addition, historical, current and forwardlooking environmental, social and sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future rule-making.

The term “project” as used in this webpage can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.